The Ultimate Guide To How To Obtain Bankruptcy Discharge Letter

The Main Principles Of How To Obtain Bankruptcy Discharge Letter

Table of ContentsThe Facts About Copy Of Chapter 7 Discharge Papers UncoveredIndicators on How Do You Get A Copy Of Your Bankruptcy Discharge Papers You Should KnowNot known Facts About Copy Of Bankruptcy DischargeThe Single Strategy To Use For Copy Of Chapter 7 Discharge PapersSome Of How Do I Get A Copy Of Bankruptcy Discharge Papers

A specific debtor under Chapter 7 bankruptcy is normally approved a discharge; nonetheless, the right to a discharge is not ensured. The notice is simply a copy of the last order of discharge as well as is not certain to the financial obligations the court determines must not be covered by the discharge. The notification educates lenders that the financial obligations owed to them have been released as well as they ought to not try any type of further collection.In enhancement, legitimate liens on details property to protect payment of financial debts that have not been discharged will continue to be in effect after the discharge, and a safeguarded financial institution deserves to impose the liens to recuperate such residential or commercial property. As pointed out over, creditors detailed on the discharge are not permitted to call the borrower or seek collection task, and also a debtor might submit a record with the court if a creditor violates the discharge order.

About How To Get Copy Of Chapter 13 Discharge Papers

Also though they may be released from their monetary commitments, personal bankruptcies stay on their document for a duration of seven to 10 years, depending on the type of bankruptcy submitted.

Nevertheless, employers can not discharge an existing staff member that is going or has undergone the procedure of bankruptcy. A court can refute a discharge in Chapter 7 for a variety of factors, including, to name a few, the debtor's failing to give tax papers that have actually been requested, destruction or concealment of publications or records, infraction of a court order, or an earlier discharge in an earlier case that began within eight years before the date the second request was submitted, as well as failure to finish a program on individual economic monitoring.

trustee may file an argument to the borrower's discharge. A discharge may additionally be rejected in Chapter 13 if the borrower doesn't finish a program on individual monetary management or if they've obtained a prior discharge in another Chapter 13 instance within 2 years before the declaring of the 2nd case, with a few exceptions - https://bankruptcy-discharge-papers.creator-spring.com.

Getting The Chapter 13 Discharge Papers To Work

Personal bankruptcy Trustee, as well as the trustee's lawyer. The trustee personally handles your personal bankruptcy instance. This order consists of notice that financial institutions should take no further activities to collect on the financial debts, or they'll deal with penalty for contempt. Maintain a copy of your order of discharge along with all your various other personal bankruptcy documents.

You can submit a motion with the insolvency court to have your situation reopened if any type of financial institution attempts to accumulate a discharged debt from you (bankruptcy discharge paperwork). The creditor can be fined if the court figures out that it violated the discharge injunction. You can try merely sending out a duplicate of your order of discharge to quit any type of collection task, and then talk with an insolvency lawyer concerning taking lawful action if that doesn't function.

The Facts About How Do You Get A Copy Of Your Bankruptcy Discharge Papers Uncovered

They consist of: Residential obligations such youngster assistance, spousal support, as well as financial obligations owed under a marriage negotiation arrangement Specific fines, charges, as wikipedia reference well as restitution resulting from criminal tasks Particular tax obligations, including illegal revenue taxes, residential or commercial property taxes that came due within the previous year, and also service tax obligations Court costs Financial obligations connected with a drunk driving infraction Condo or other house owners' organization costs that were imposed after you applied for personal bankruptcy Retired life plan loans Financial debts that weren't discharged in a previous personal bankruptcy Financial obligations that you failed to note on your bankruptcy request Some financial debts can't be released under Chapter 13 insolvency, consisting of: Youngster assistance as well as spousal support, Certain penalties, fines, and restitution resulting from criminal activities, Specific taxes, including fraudulent income tax obligations, real estate tax that ended up being due within the previous three years, and organization taxes, Financial debts you didn't list on your bankruptcy request, Financial obligations sustained because of personal injury or fatality created by driving while intoxicated, Financial obligations arising from fraud or recent luxury purchases Lenders can ask that particular debts not be released, also if discharge isn't banned by law.

Your insolvency defense doesn't reach joint account owners or cosigners on any of your debt obligations. Just your individual responsibility for the financial obligation is gotten rid of when you get your personal bankruptcy discharge. Your cosigner stays on the hook for the entire equilibrium of the financial debt. Lenders can still gather from, and even sue, cosigners and also joint account owners for released debts.

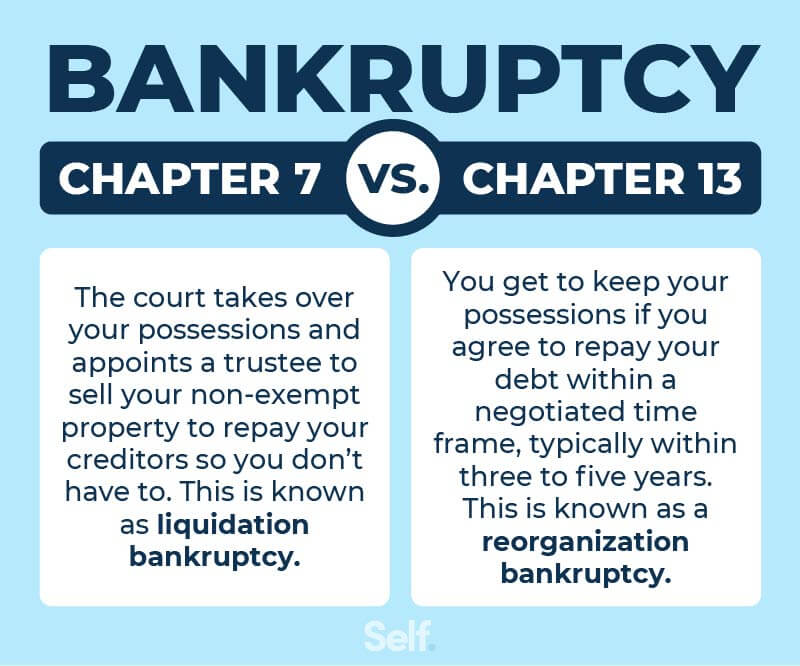

The discharge happens besides the payments under the repayment strategy have actually been made in a Chapter 13 personal bankruptcy, normally three to 5 years. A personal bankruptcy discharge efficiently erases specific financial debts. Lenders can no much longer attempt to accumulate on released financial obligations, although they can still seize home that's been pledged as collateral for those financial debts.

Fascination About How Do You Get A Copy Of Your Bankruptcy Discharge Papers

Debtors need to realize that there are a number of alternatives to phase 7 alleviation (how do you get a copy of your bankruptcy discharge papers). As an example, borrowers that are taken part in service, including companies, partnerships, and single proprietorships, might choose to stay in company and also avoid liquidation. Such borrowers must think about filing a petition under chapter 11 of the Insolvency Code.

P. 1007(b). Borrowers need to likewise provide the assigned instance trustee with a copy of the tax return or records for the most current tax year as well as tax returns filed throughout the situation (including tax returns for prior years that had actually not been submitted when the situation started).